The project challenge was provided by a client, which is a leading financial services company in Norway. The focus is on the implementation of conversational AI in the investment field. The aim is to trigger young adults to start investing. The project followed an agile way of thinking and developing to deliver UX design concepts within one week, which include ideating, user journey mapping, wireframing, prototyping and usability testing. And the final design solution was presented to the client for future guidelines and suggestions. In the design and research process, user research, expert evaluation and userability testing were developed to draw the potential user journey and the final layout is digital UI.

| Time frame: | 04.2021 (one week project) |

| Client: | MIRABEAU|Nordic Bank |

| Category: | B2B, Investment, UI, Sustainable design, Banking app |

| Development: | Empathizing methods & Affinity mapping, UX client requirement, Usability testing |

| Share: |

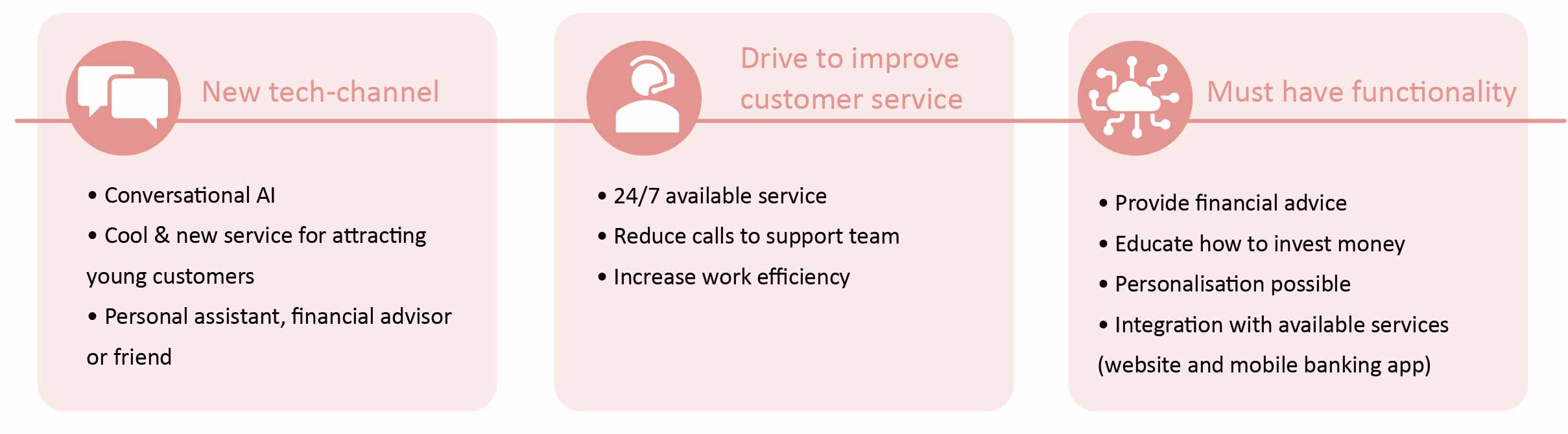

The client would like to attract new customers and increase sales through a new medium, Conversational AI. They want to focus on young adults that want to start saving and investing but don’t know how, guiding them on how to save and invest for long-term wealth and a safer future. They need the new solution to be easily integrated with their existing digital products, which are webside and mobile banking app

Given the current context of the pandemic, the competition already joined this market by targeting these young people to show them they could start investing. That’s where the client also want to commit to. By offering young adults proper channels, the focus group are able to convince themselves in doing investment.

Client Requirements

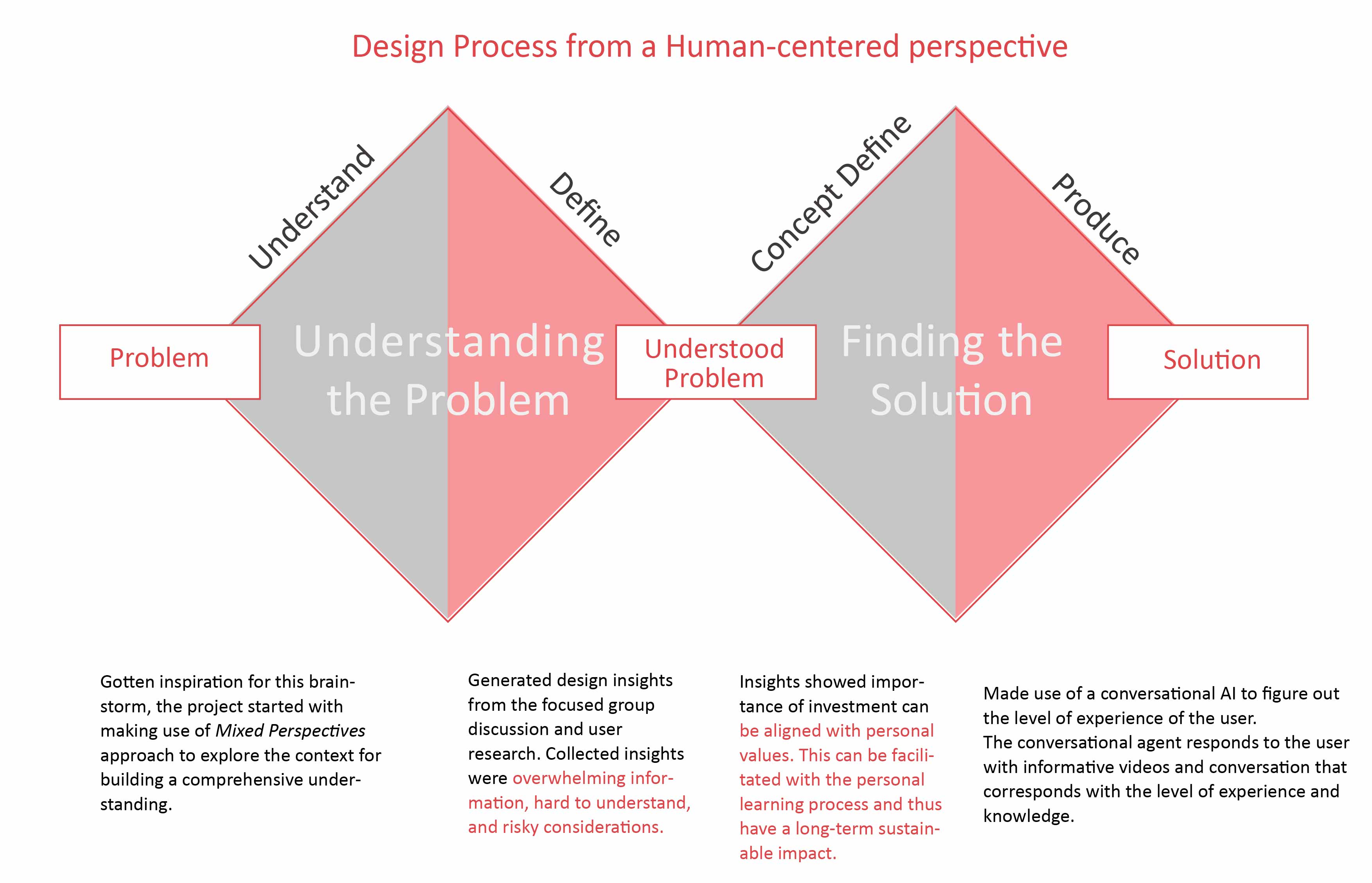

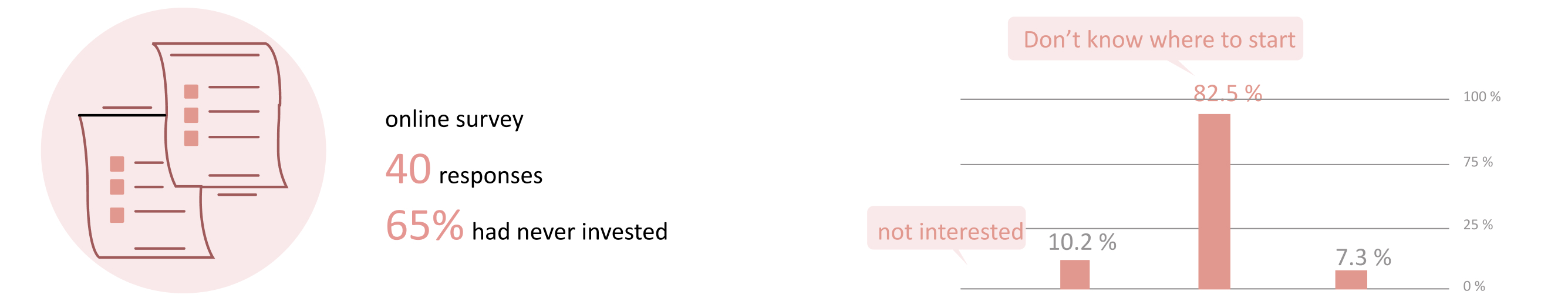

Based on empathizing methods, such as self-understanding and experiences of using banking relevant apps (1st person perspective), there are 3 aspects that exist in the general user experiences: overwhelming information, hard to understand, and risky considerations. To understand more in depth about how people perceive using banking/investing apps, the research started with an online survey with responses from 40 participants. 65% participants showed that they had never invested before, in which 82.5% presented that it was because they had no idea about where and how to start.

The above findings showed that the importance of investment can be aligned with personal values. This can be facilitated with the personal learning process and thus have a long-term sustainable impact.

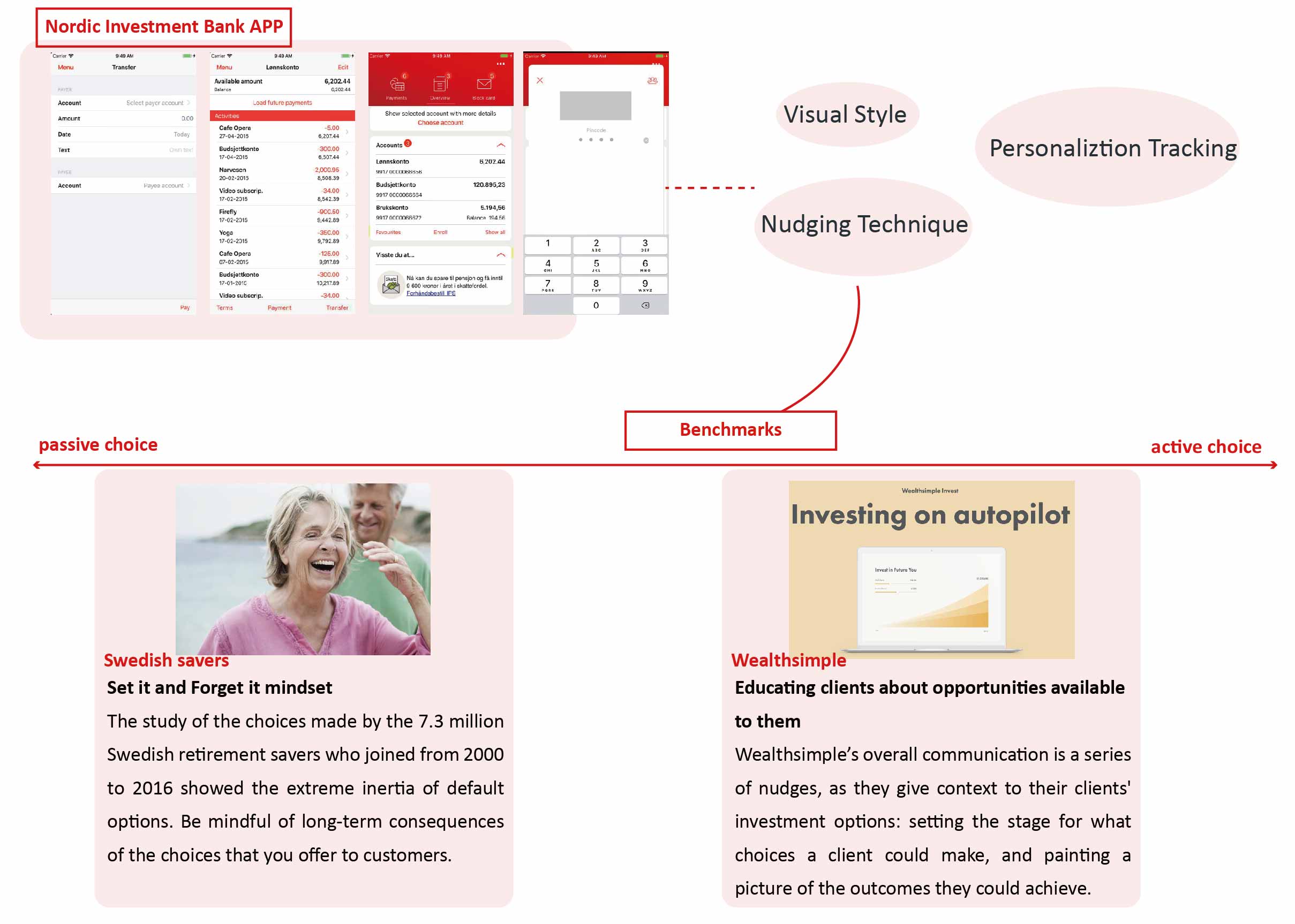

Therefore, these core elements were converted as observatory insights with the current Nordic Bank App for the benchmark inputs. The benchmark focuses on the areas where users/customers received assistance.

Benchmark based on the core features identified from the current Nordic Investment Bank App

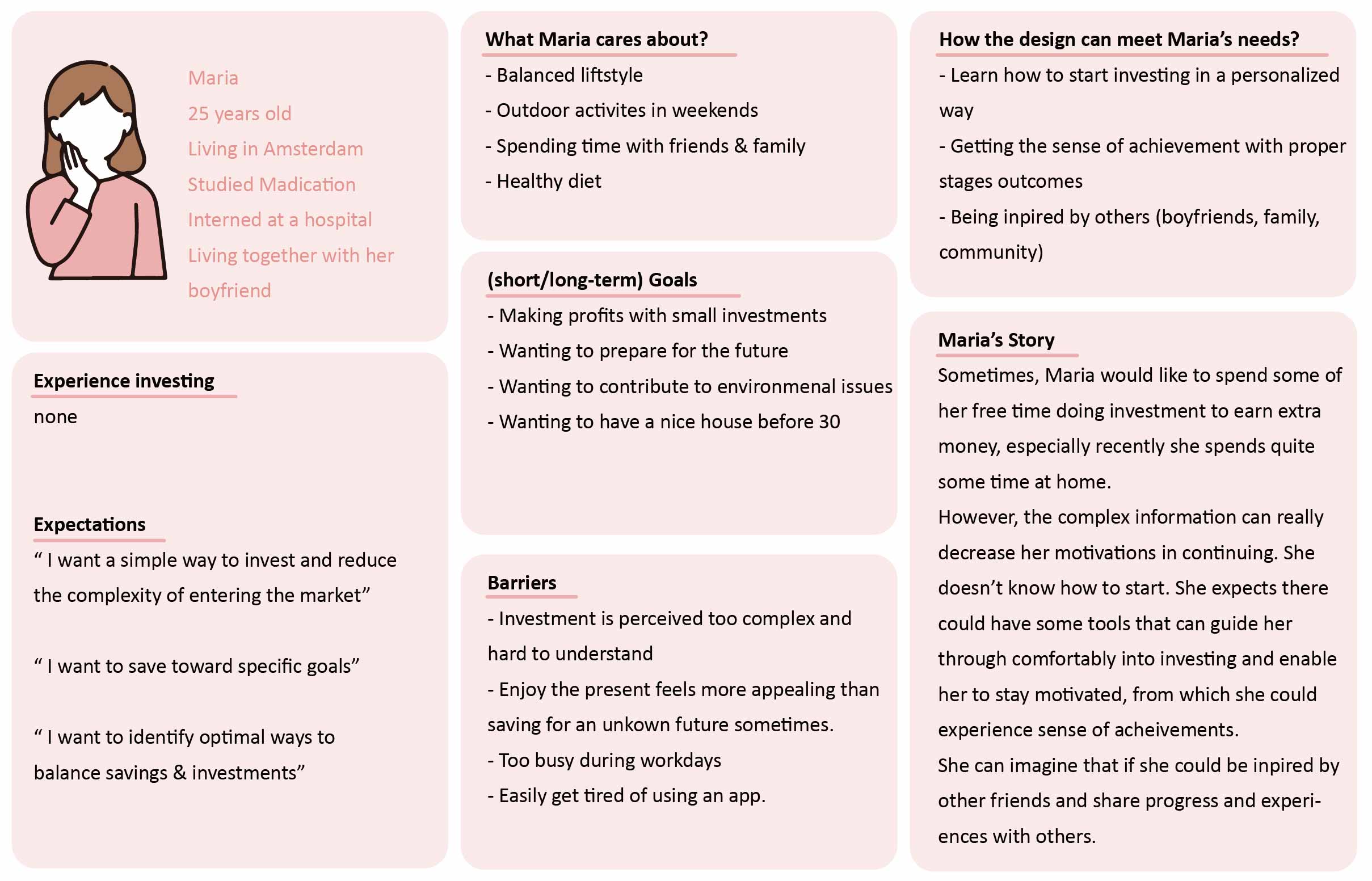

To generate more user insights, a brainstormed session was held to map the insights based on previous research. Followed by building Persona and User Journey map to dive into the user experience and thoughts across the journey in the potential solution.

Persona mapping

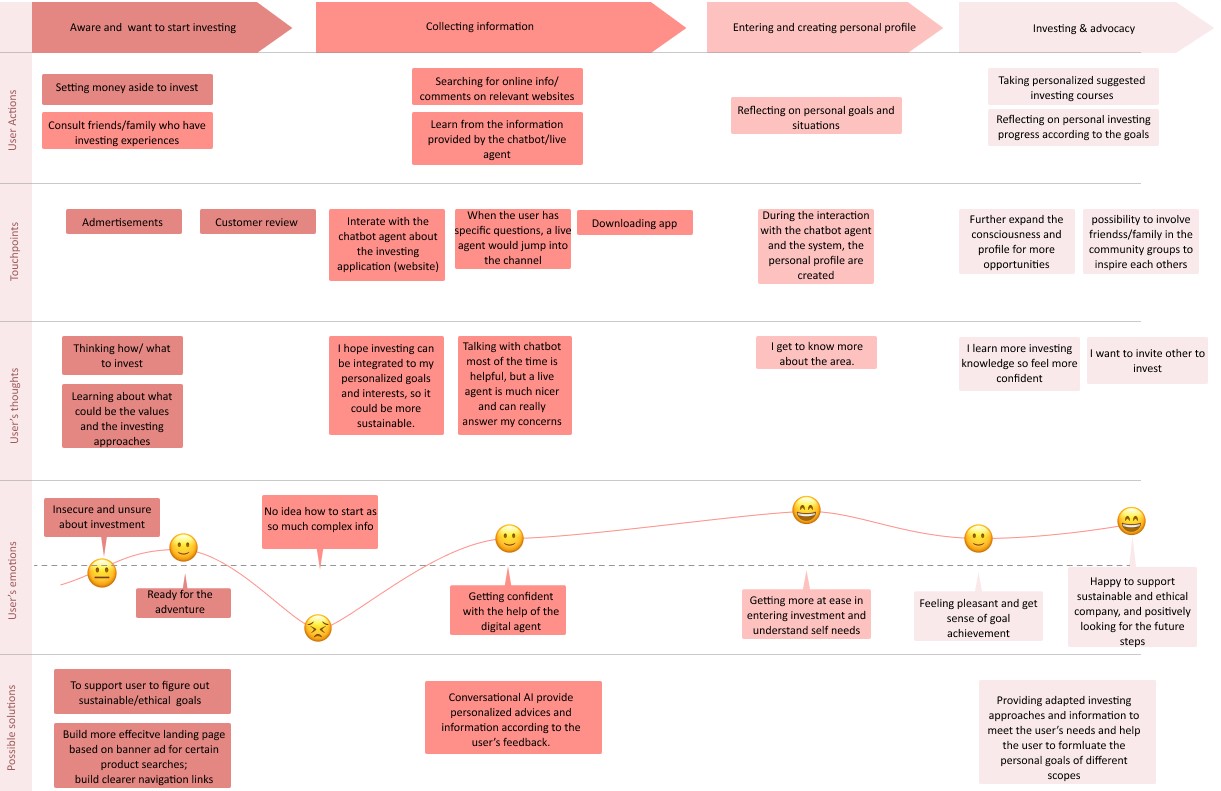

User Journey map based on the end users insights (Persona, Mixed perspectives) and busniess values mapping

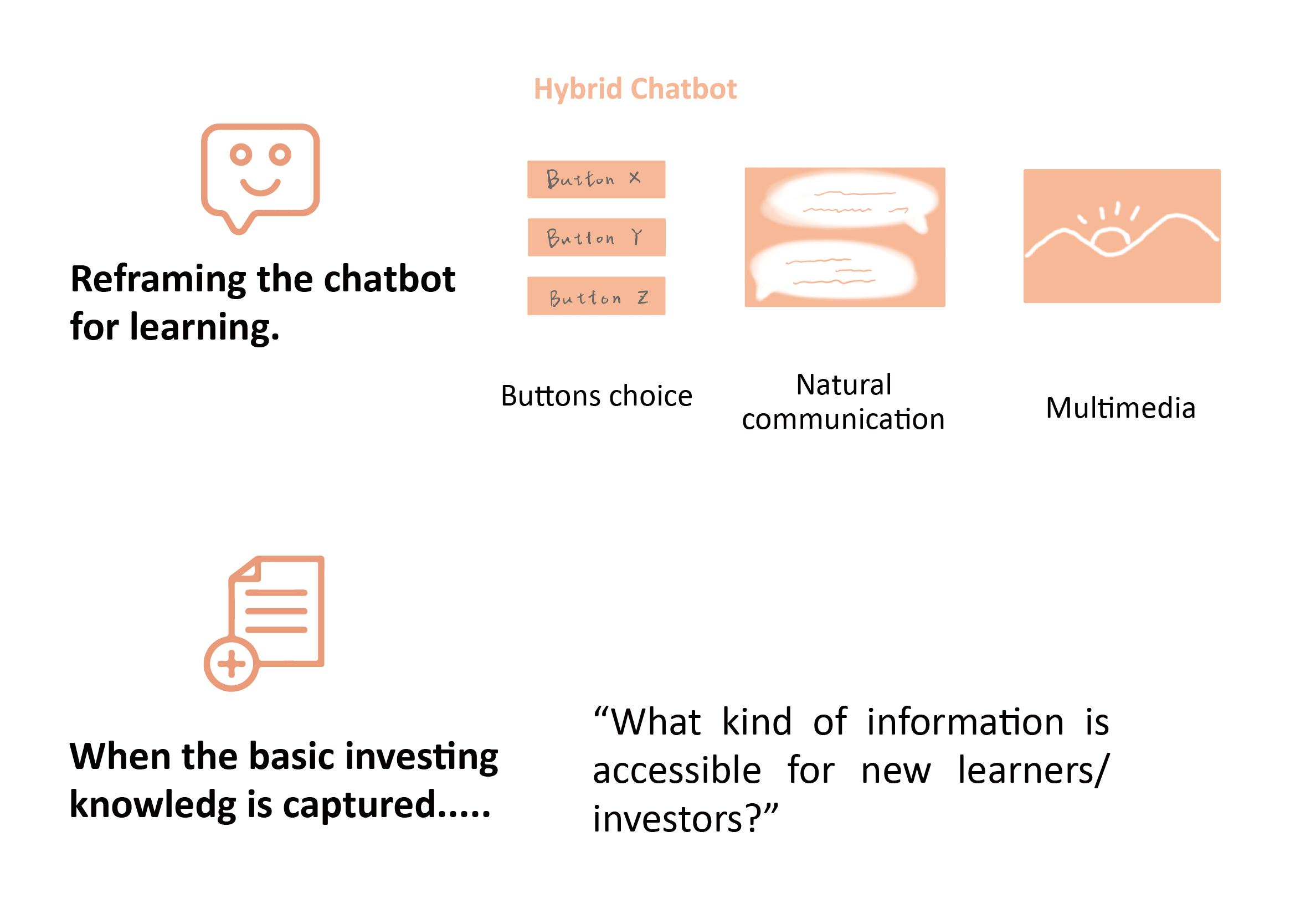

During the debriefing to the young target users and research, some important elements are collected to arouse the interests of young adults. These considerations involve the role of conversational AI(chatbot) and adopt multiple approaches that young adults are familiar.

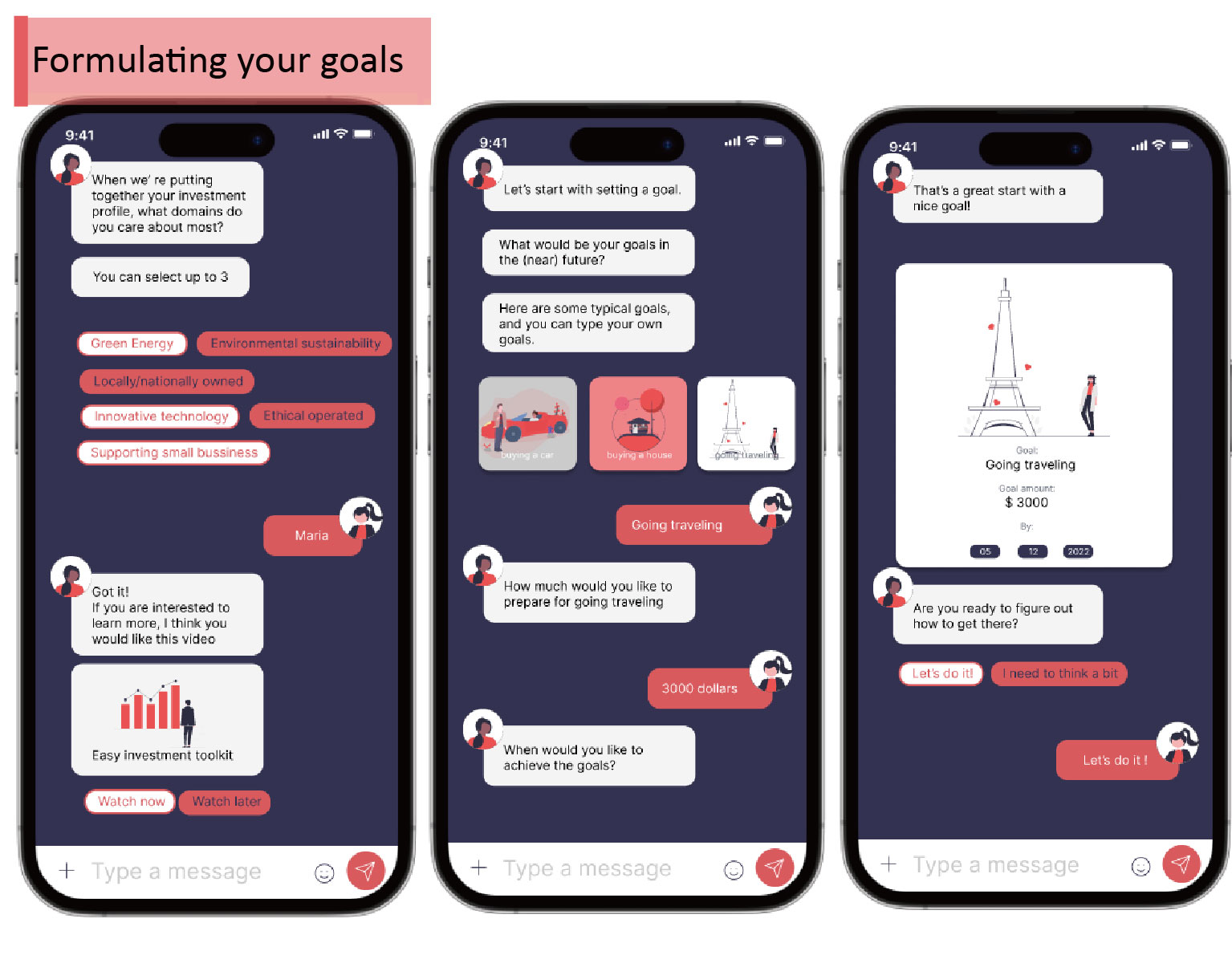

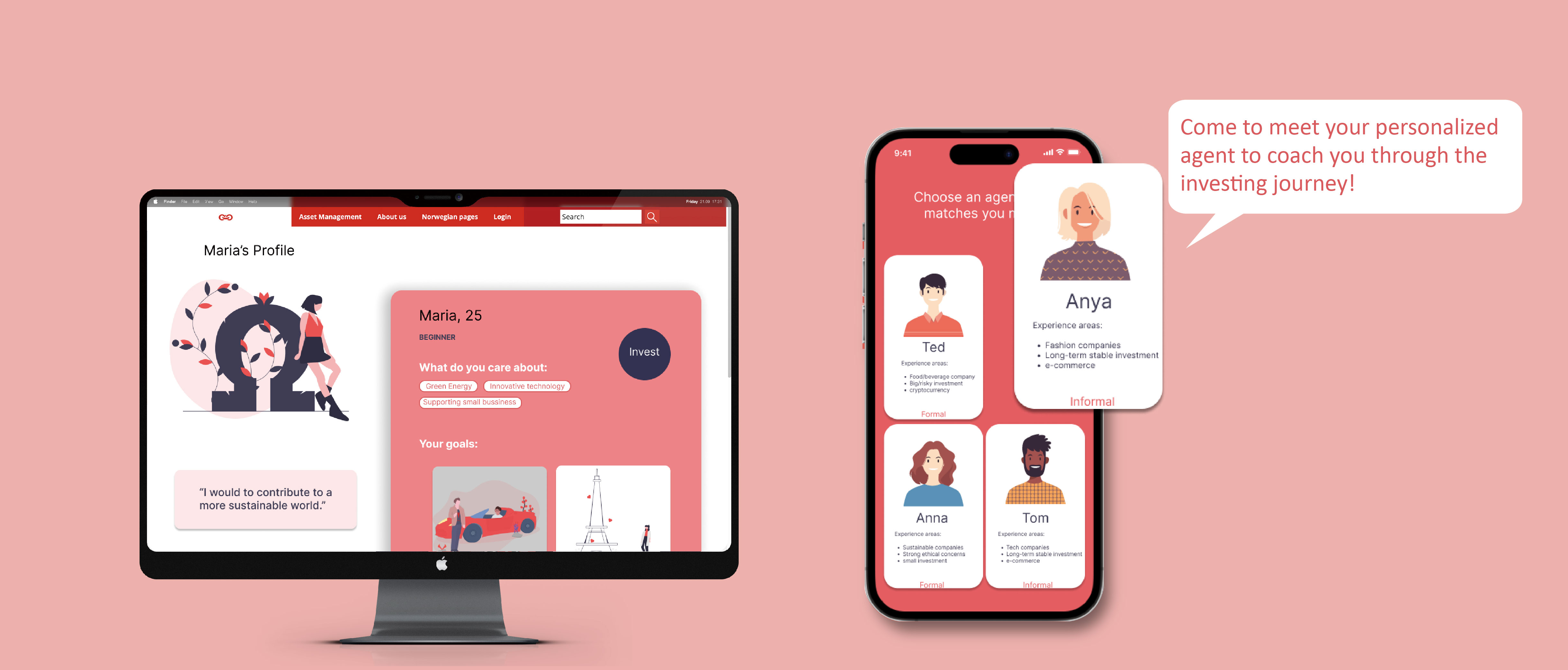

Elements/approaches (personalized goal setting) to intriguing young taget group to start their first investment

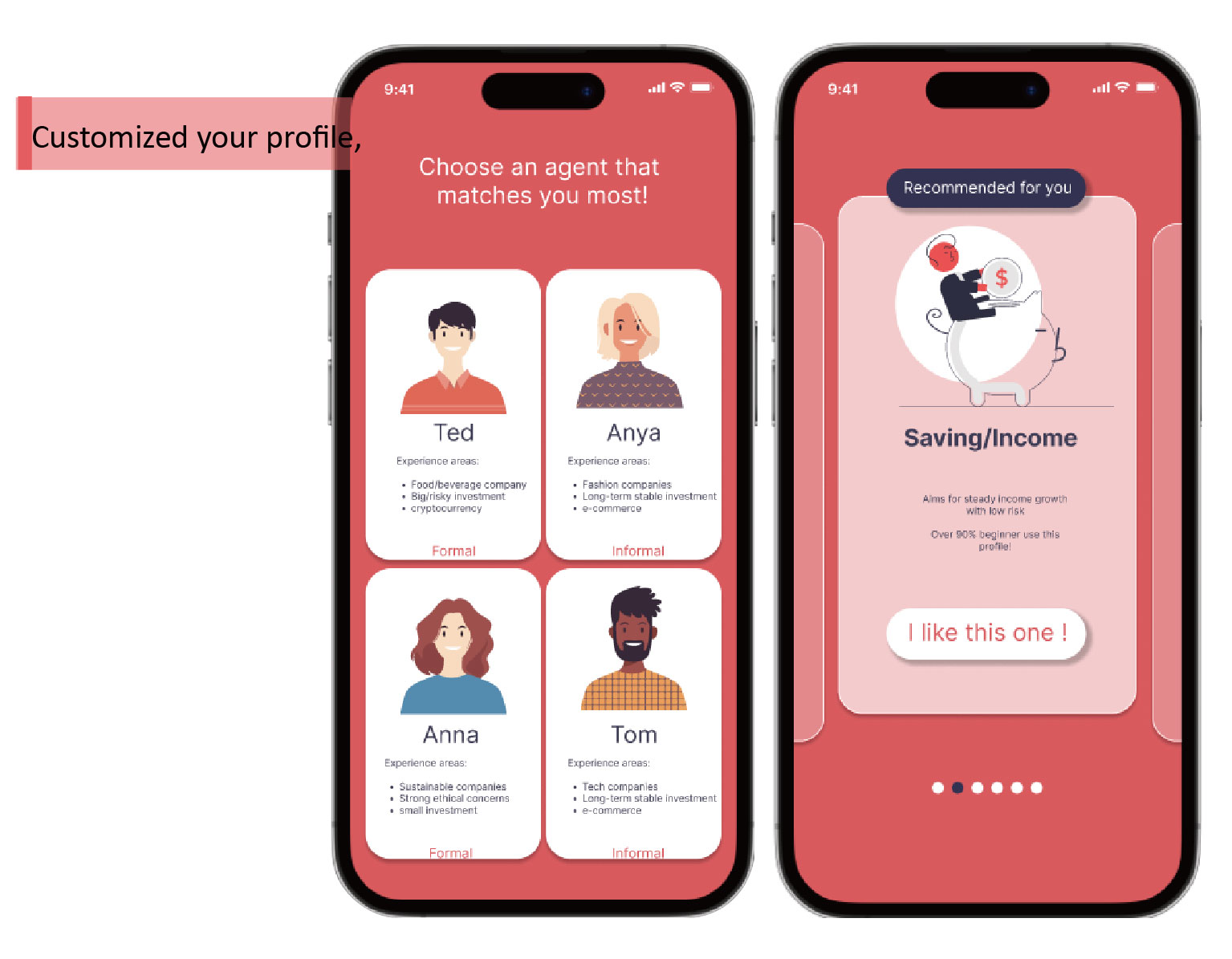

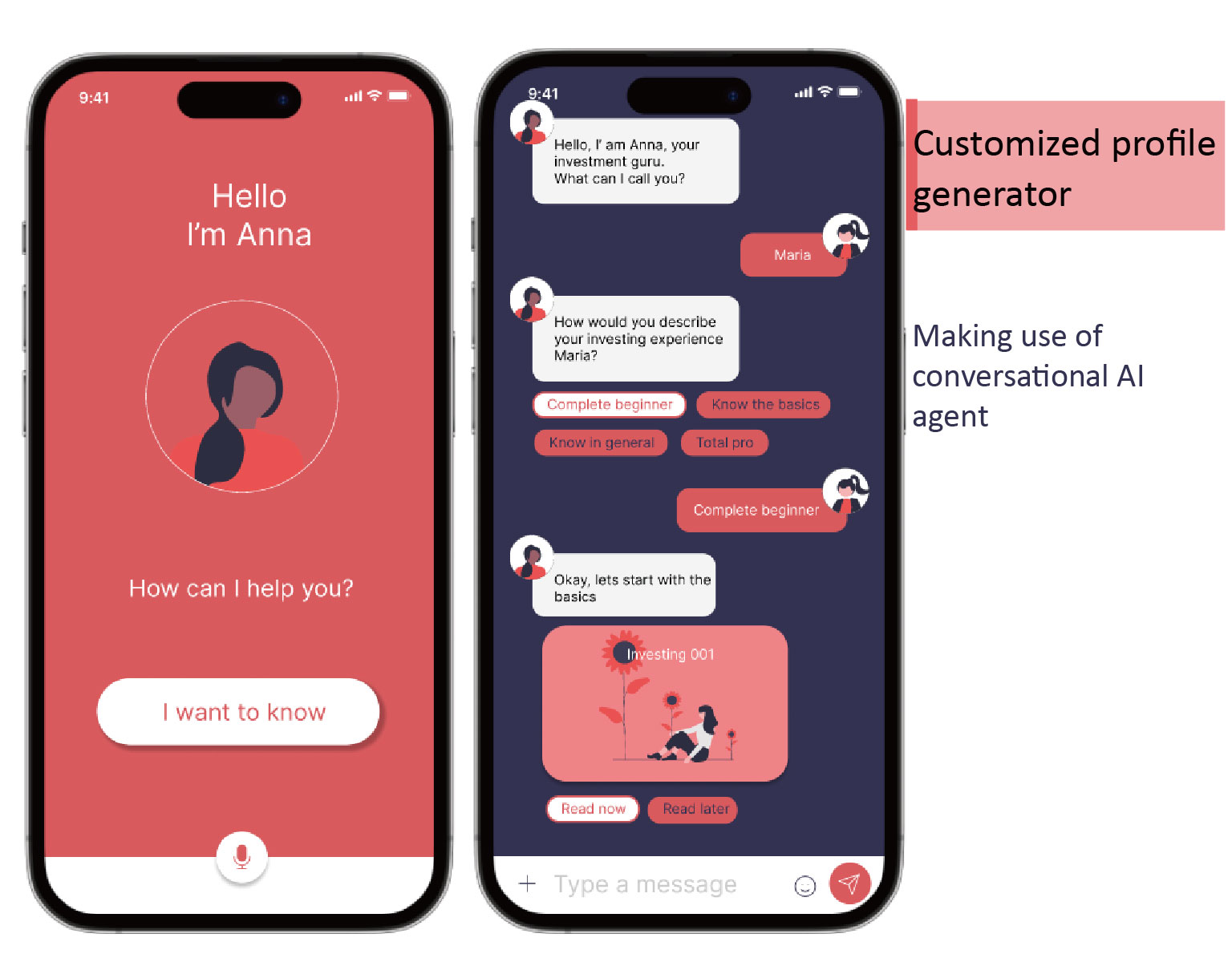

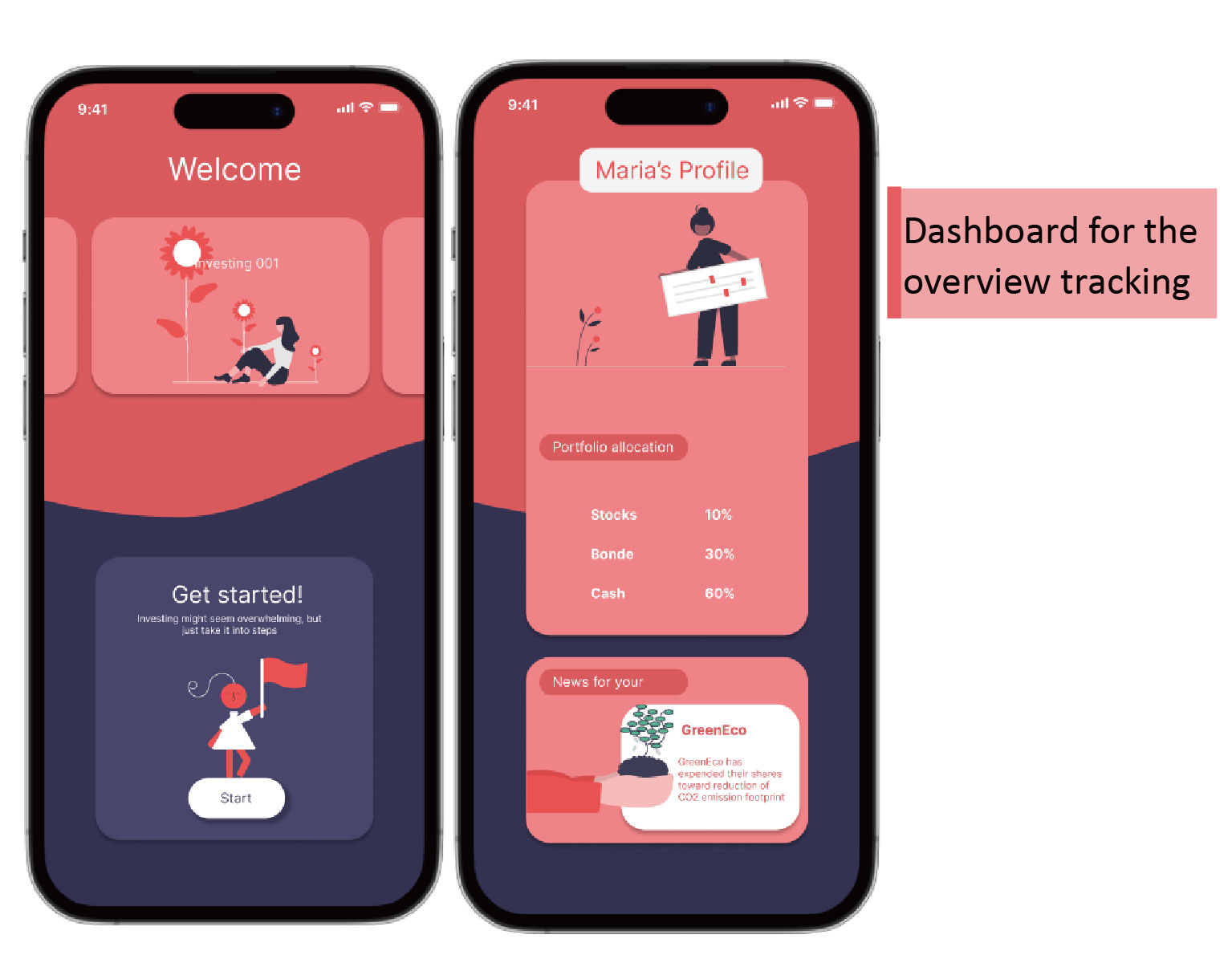

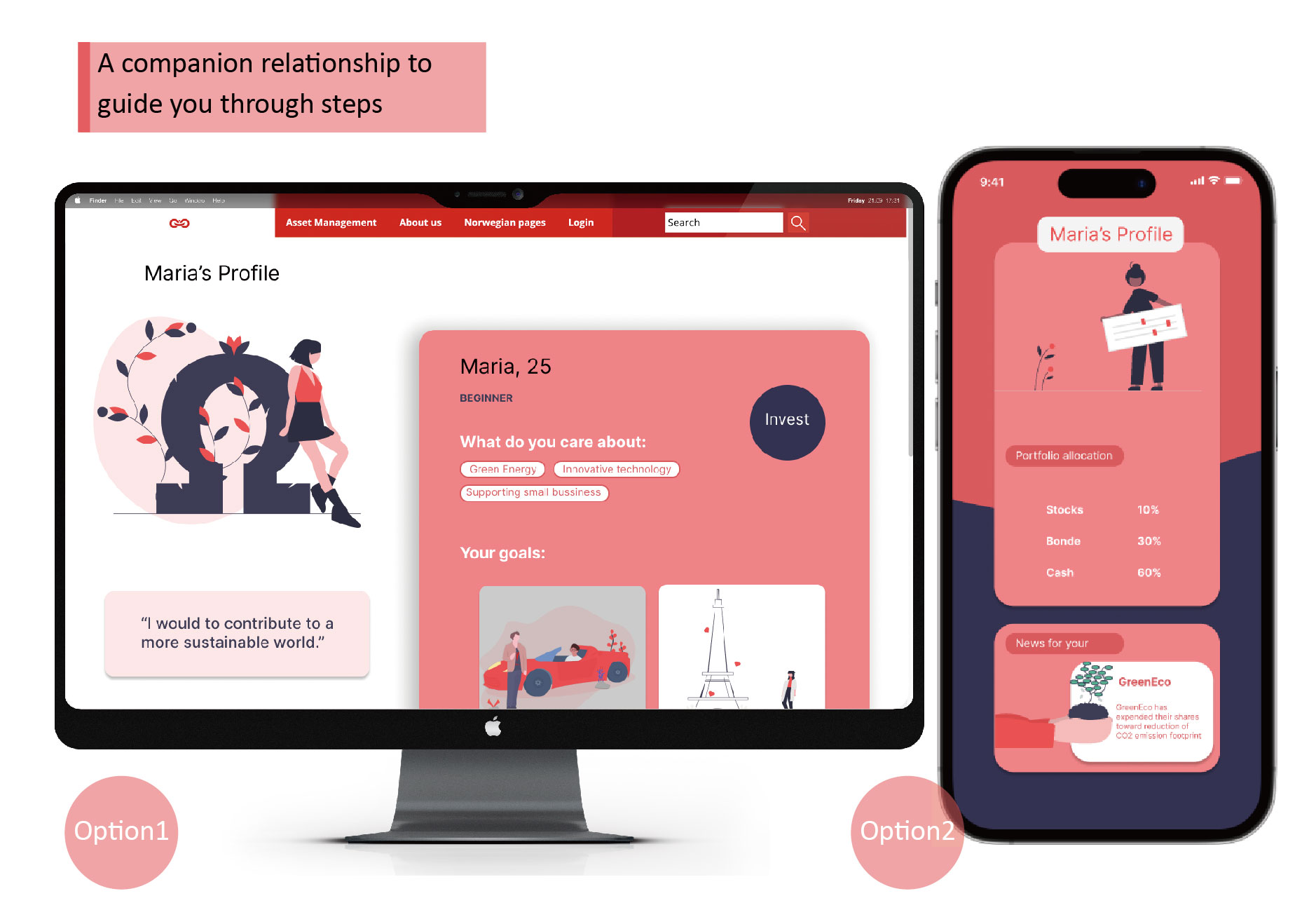

In the final UI, the user has the possibility to choose a personal assistant and therefore also the layout. In the chat between the personal assistant and the user, it is visible that the choices for the user remain limited, but that they have the opportunity to provide input themselves. The recommendation element of videos and podcasts also remains present in collaboration with BetterInvesting, where the number of recommendations stays limited in order to positively influence the UX. In addition, the personal goals are also displayed visually and there is a clear personal page where the user can gain insights about, for example, the personal goals and the shares. The insights during the feedback session made a positive contribution to improving our application for the Nordic bank.